How startups die from their addiction to paid marketing

[Originally tweetstormed at @andrewchen, Follow me for more!]

Many of the biggest implosions in recent history – especially ecommerce – have been due to startups getting addicted to paid marketing while fooling themselves on Customer Acqusition Costs. As spend scales, it always gets more expensive and harder to track – never less.

A familiar story: New product launches. Nice spike, but it dies down. The product is low freq – gotta spend to grow. Marketing spend increases, it’s profitable! More is spent, more money is raised via VCs. OMG this is working! Party!

Suddenly top line hits a ceiling. Payback period goes from 9 months to 12, then more. Unit economic profitable, but not with staff + HQ. Without top line growth, more investment dollars can’t be raised. Budgets get slashed, then layoffs.

Even slower growth means a pivot is in order. Try something else, also powered by paid marketing. Maybe subscription? Premium? Try another thing. Then another. Irrelevance – or maybe bankrupcy.

This happens enough that y’all should be nodding your heads now – it’s tough, but there’s a pattern. This is the Paid Marketing Local Max.

The key insight here is that Paid Marketing is tricky to grow, at scale, as the primary channel. It’s highly dependent on both against external forces – competition and platform – as well as the leadership team’s psychology when things get unsustainable.

The first mistake is to start by thinking of everything as Blended CAC – dividing all your acquisition against dollars – as opposed to understanding CAC of each channel (Facebook, Google display, Google AdWords, etc.). The former is misleading.

Because your initial organic users are your biggest fans, your Blended CAC and per-channel CAC can often by off by 2-5X. As you scale your paid, your organic won’t follow 1:1. So as you grow, your Blended will approach your dominant channel’s CAC.

Scale effects mostly work against you in paid marketing. The longer your campaigns run, the less effective they become – people start seeing your ads too often. The messaging becomes stale, and novelty effects are real. Market performance has a reversion to the mean.

Saturation is also a thing. As you buy up your core demographic, the extra volume comes from non-core, who are less responsive. The first US-based ad impression on a property is the most responsive, but you eventually run out of those.

Competitive dynamics are real. They’ll come in to copy not just your product, but also ad messaging and creative. It’s not hard to fast follow, especially if you can start the test just with a experiments on millennial-friendly ad copy and landing pages.

Contrast that to viral channels, folder sharing in Dropbox or team channel creation for Slack – these are highly situational and only a few folks can copy. Whereas in ads you’re competing with everyone going after your same demographic.

Addiction to paid marketing can get you into a local maximum. It’s much harder to fix the underlying issues – creating real moats, product differentiation, doing deeper adtech integrations. Easier to just spend more and push the LTV window from 9 months to 12 to 18.

There’s a few scenarios where paid marketing is justified, but it’s situational. If your product has network effects that kick in after an activation point and really scale, you can use paid to help bootstrap that. Facebook uses paid to build out new regions, for example.

If you are really going to invest a ton of time from engineering/growth to integrate with all the APIs, try out a ton of things algorithmically, then you can develop a lasting edge. I’ve heard Wish does this well, but it’s not common.

The new generation of ad platforms makes it possible to scale revenue to new heights, but without profitability. Make sure you don’t get addicted. Build out new channels. Fix churn and frequency. Don’t congratulate yourself too early. And calculate LTV/CAC correctly :)

So what do you do about it? One of the best case studies of this is from @drewhouston’s Dropbox presentation from the early days. Lots of great stuff in this deck and it’s worth paging through, now nearly 10 years later. Here it is.

On slide 18, Drew talks about early experiments they did on paid search. They executed the industry best practices at the time – go to trial-based pricing, hide the free option, optimize landing pages. Slide:

What they learned was that, in the mature market for cloud storage, there was already a lot of competition. All the paid marketing channels were unprofitable. Hiding the free option wasn’t user aligned. Etc etc.

The obvious move would have been to continue to grind on the problem! Tweak pricing, optimize more ads/funnel/landing pages, etc. And many would have been tempted to do that, because it’s worked for others

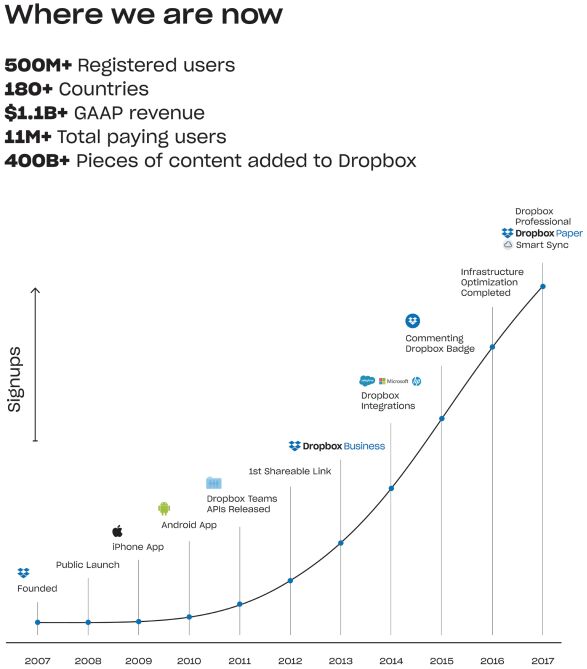

The interesting thing, and you can see in the deck, is that grew virally instead – via folder sharing, the give/get disk space program, etc. It seems obvious now, remember that back in the day, “cloud storage” was the space, and it’s not clear that you can go viral there.

Dropbox has done well since then, of course!

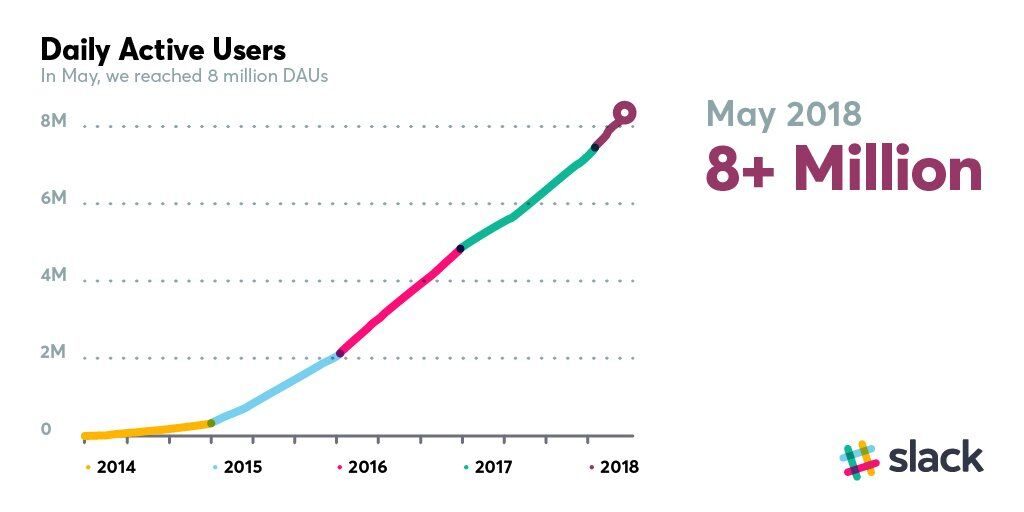

As an aside, isn’t it interesting that exponential growth curves always look linear instead? Here’s Slack’s as well:

In some ways, you could argue that Dropbox is lucky that their initial forays into paid marketing didn’t work. That made it easier for them to stop their efforts there, and to focus on the viral channels that are now their bread and butter.

On the other hand, it takes a lot of insight and reflection to go away from the current industry “best practices” – even if they erode profitability, cause shark fins, etc.

So for those of you who are thinking about going all-in on paid marketing, I challenge you to go deeper on that strategy. Perhaps cap your paid acquisition at 30-40% of TOF. Instead, where can you innovate?

In addition to Dropbox, I sometimes use the story of @Barkbox, which created a whole media property, Barkpost (http://barkpost.com ) as a viral content sharing engine that can cross-sell the subscription product.

Or at Uber, although they never became significant channels, we were keen to work on sharing viral sharing features like Share ETA, Fare Split, and Location Sharing to potentially drive acquisition.

The point is, knowing that Paid Marketing is highly addictive and hard to scale down, all of us in the industry should always be thinking about the 2nd or 3rd channel, in addition to organic/WOM, to give us a way to wean off an ever-increasing ad budget.

To do that, you’ll need empower your creative team to attack the problem from all angles- new viral product features, really investing in your referral program, building out your content/SEO strategy even though it’ll take years. It’s worth the investment!

PS. Get new updates/analysis on tech and startups

I write a high-quality, weekly newsletter covering what's happening in Silicon Valley, focused on startups, marketing, and mobile.

Views expressed in “content” (including posts, podcasts, videos) linked on this website or posted in social media and other platforms (collectively, “content distribution outlets”) are my own and are not the views of AH Capital Management, L.L.C. (“a16z”) or its respective affiliates. AH Capital Management is an investment adviser registered with the Securities and Exchange Commission. Registration as an investment adviser does not imply any special skill or training. The posts are not directed to any investors or potential investors, and do not constitute an offer to sell -- or a solicitation of an offer to buy -- any securities, and may not be used or relied upon in evaluating the merits of any investment.

The content should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Any charts provided here are for informational purposes only, and should not be relied upon when making any investment decision. Certain information contained in here has been obtained from third-party sources. While taken from sources believed to be reliable, I have not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. The content speaks only as of the date indicated.

Under no circumstances should any posts or other information provided on this website -- or on associated content distribution outlets -- be construed as an offer soliciting the purchase or sale of any security or interest in any pooled investment vehicle sponsored, discussed, or mentioned by a16z personnel. Nor should it be construed as an offer to provide investment advisory services; an offer to invest in an a16z-managed pooled investment vehicle will be made separately and only by means of the confidential offering documents of the specific pooled investment vehicles -- which should be read in their entirety, and only to those who, among other requirements, meet certain qualifications under federal securities laws. Such investors, defined as accredited investors and qualified purchasers, are generally deemed capable of evaluating the merits and risks of prospective investments and financial matters. There can be no assurances that a16z’s investment objectives will be achieved or investment strategies will be successful. Any investment in a vehicle managed by a16z involves a high degree of risk including the risk that the entire amount invested is lost. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by a16z is available at https://a16z.com/investments/. Excluded from this list are investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets. Past results of Andreessen Horowitz’s investments, pooled investment vehicles, or investment strategies are not necessarily indicative of future results. Please see https://a16z.com/disclosures for additional important information.