Texas, Florida Top 2023 Best & Worst States For Business Survey

It was the big question going into our annual Best & Worst States survey of CEOs this year: Would Florida Governor Ron DeSantis’s high-profile battle with Walt Disney Co. sour CEOs on Florida as a site for locating and expanding their companies?

The answer, it seems, is no.

The Sunshine State held on to its No. 2 ranking in the 2023 Chief Executive Best and Worst States for Business survey of chiefs. The state’s low taxes and strong stance against pandemic-motivated business shutdowns boosted Florida’s popularity among business owners, helping kick off a stronger stream of migration to the state from relatively locked-down places including New York.

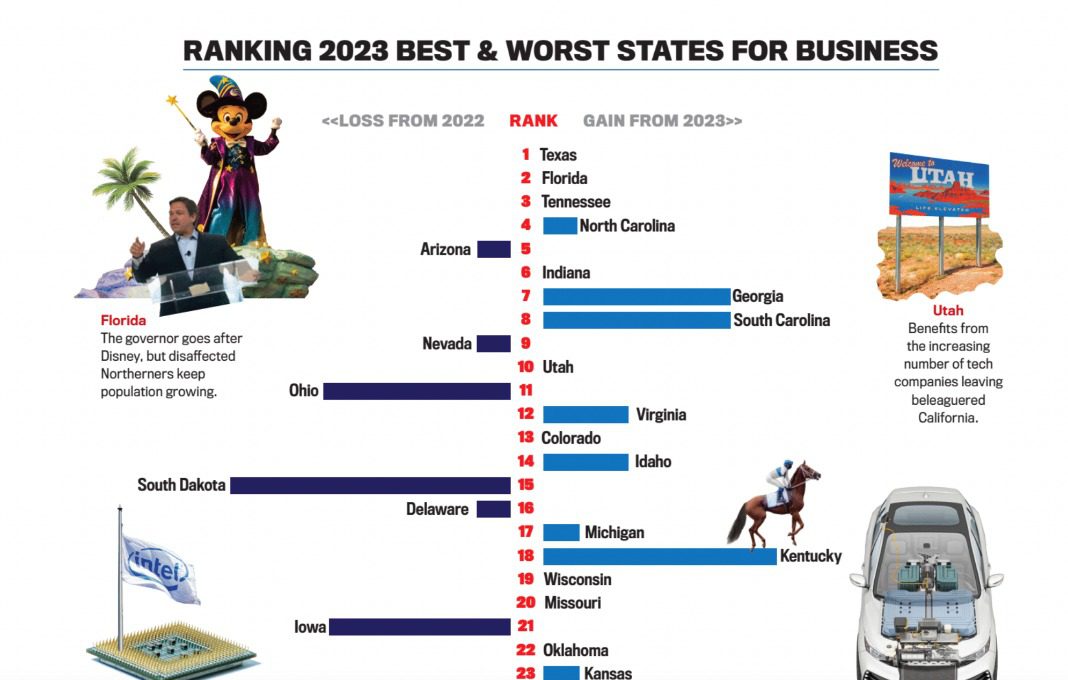

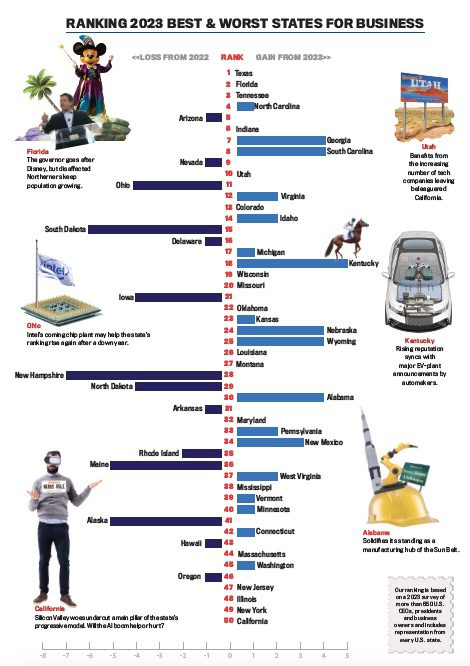

And, among the chiefs surveyed for the 2023 rankings, Florida actually picked up a bit of ground versus No. 1 Texas. But still, it did not overtake the Lone Star State. Texas once again lands at the top of our poll of U.S. CEOs—as it has every year since Chief Executive began compiling the list in 2001. The state’s combination of business-friendly policies, growing cities, a rising professional class, and a direct appeal to CEOs who aren’t happy with California continues to keep Texas at the head of the class.

Tennessee also repeats as No. 3 in state business climate in CEOs’ assessments. North Carolina, at No. 4, and No. 5 Arizona flipped spots this year. No. 6 Indiana has become a mainstay near the top as well.

Just as CEOs in the survey have solidified their opinions about the welcoming top states, they also have ossified their regard for the worst: No. 47 New Jersey, No. 48 Illinois, No. 49 New York and No. 50 California remained the same as in the 2022 survey.

But in between, there were some significant advances in this year’s ranking, especially the rise of Georgia and South Carolina, each up four spots, to No. 7 and No. 8 in the Chief Executive list. They’ve joined Florida in the broad advance of the Southeast, especially as a new manufacturing hub.

Other notable rises include Virginia, which moved up two spots, to No. 12, and Idaho, which advanced two spots to No. 14. Kentucky moved up five spots, to No. 18. Meanwhile, Ohio dropped by four slots, to No. 11, and South Dakota fell by a remarkable six spots to No. 15.

Broadly speaking, the trends dictating how states are performing as economic actors these days extend beyond CEO opinion to include foreign companies’ increasing embrace of the U.S. market; reshoring and a renaissance in domestic manufacturing; the leveraging of state coffers flush from recent federal largess through tax cuts and other means; the rising value of experienced labor along with the expansion of automation; and the pandemic-era migration from city cores to exurbs and beyond.

Florida has exhibited more of the same characteristics as Texas over the last several years, with a decidedly stronger tilt toward business beginning with the start of DeSantis’s term as governor in 2019, after he had been a U.S. House member. The state’s strong stance against pandemic-motivated business shutdowns seems to have boosted Florida’s popularity among business owners as well, adding to a migration boom. More than 700,000 people have moved to the Sunshine State since 2020, according to the U.S. Census.

DeSantis’s battle with Disney, critics said, might threaten that standing. As the developer and owner of Disney World and other major tourism properties in the Orlando area, Walt Disney became one of the state’s most significant economic actors over the last half-century. But DeSantis attacked the company early last year over then-Disney CEO Bob Chapek’s references to sexual orientation and gender identity in Florida’s elementary-school curriculum, the so-called “Don’t Say Gay” bill.

Then DeSantis sought to retract some of the unique financial and governance advantages that Disney has enjoyed in Florida since its entry into the state, also citing the company’s broad advance into “woke” ideology that the governor sees as antithetical to Florida’s families.

Disney has fought back hard, and the battle between Florida’s Republican-controlled government and the increasingly progressively minded Disney management, in part reflecting its workforce of young creatives, has only intensified over the last several months, with DeSantis also emerging as a strong likely contender for the GOP presidential nomination in 2024.

Other emergent regional trends are evident in the 2023 Best and Worst States for Business results. South Carolina and Georgia have become big winners in states’ hunt for domestic manufacturing jobs, especially among global auto companies expanding their U.S. factory footprints for the transition to all-electric vehicles.

The Midwest, too, gained in some places even as Indiana continued to hold down the region’s preeminent spot in the opinion of CEOs. The Hoosier State keeps adding factory jobs, as well, in the EV and microchip sectors through announced new projects, while Kentucky gained five spots, to No. 18, with automakers’ plans for big EV investments there. Wisconsin, Missouri and Kansas were among Midwestern states that held about steady this year from 2022, while Ohio and Iowa each lost four spots in the rankings.

Another notable trend that built on itself in the 2023 Chief Executive survey was the further rise of Rocky Mountain States in the opinion of CEOs. Utah held steady at No. 10, and Colorado likewise at No. 13, while Idaho gained two spots, to No. 14, And Wyoming gained four spots, to No. 25.

One of the dynamics feeding the rise of the Mountain West states, CEOs said, was their attractiveness as places to land for companies that continue to flee California. The Golden State’s anti-business policies have been chasing enterprises to elsewhere for many years, but California’s fiscal environment has gotten much worse over the last couple of years as Silicon Valley giants have been laying off hundreds of thousands of workers.

Tech layoffs amounted to an estimated 333,000 just since last year, according to a new study by Boston Consulting Group. California workers certainly have suffered the most. This has placed more pressure on the state’s tax coffers, meaning Governor Gavin Newsom is likely to turn even more to companies to fill the financial gap.

Recession? What recession? Our annual CEO survey of the Best and Worst States for Business finds relentless activity all across America, fueled by the still-hot economy, foreign capital and the gold rush for EVs and chips.

The new global center of robotics? Pittsburgh takes off the Rust Belt to emerge as a place where the demise of a driverless-car startup simply leads to more startups.

Indiana’s lifestyle initiative. Commerce Secretary Chambers focuses on developing industries of the future and on giving many locales the tools.

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.