What CEOs Really Get Paid In America Now

As inflation soared across industries and around the world, everyone from middle management to front line and back-office employees saw unprecedented wage increases in 2022. The leader of the C-Suite? On average, not so much.

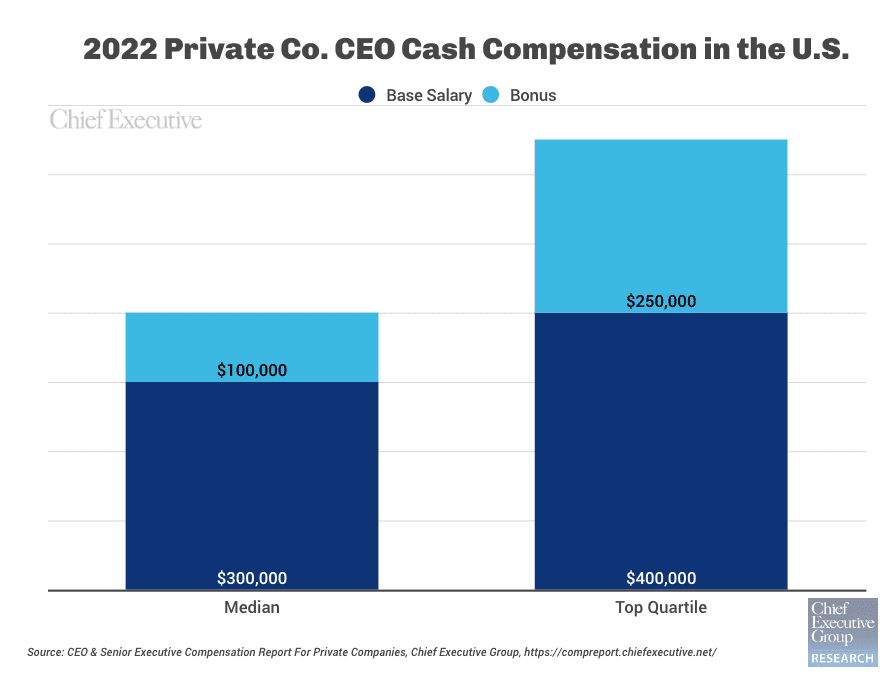

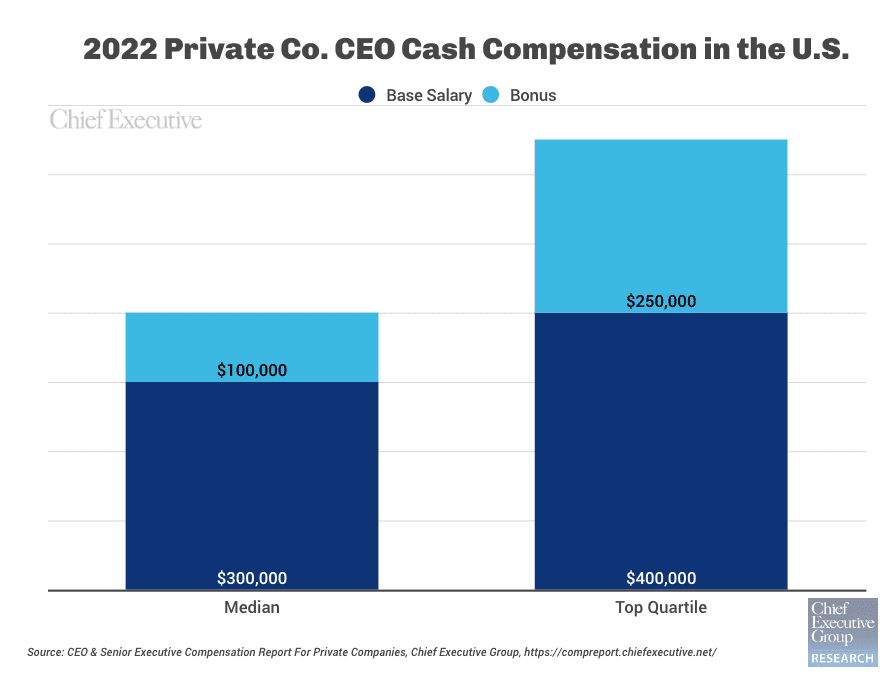

Data from Chief Executive’s annual research on the compensation plans of over 1,800 U.S. private companies—the largest such survey of its kind the nation—shows that the median base salary change for private company CEOs consistently lands at 0 percent, and their 2022 bonuses aren’t expected to climb at the same rate they have in the past. The median CEO earned a total cash compensation of $400,000 in 2022, up 3.6 percent from 2021—a far cry from the 17.1 percent raise reported in similar studies of the nation’s executives.

Even for CEOs within the 75th percentile of pay, the numbers don’t come anywhere near the massive compensation plans of the top-paid CEOs. Actual total cash comp for those in the top-quartile of CEOs was $650,000 in 2022—a 1.5 percent increase from 2021. For those keeping score, that’s less than 12 times the median annual earnings of workers in the U.S.—unchanged from last year and inconsistent from the 339-times figure (based on the largest public companies) that made ripples after it was reported in The New York Times.

Preliminary data for 2023 doesn’t show much will be changing either: The majority of companies are reporting minimal (<5 percent) change to the median CEO compensation this year, vs. prior year. This comes as no surprise for anyone familiar with senior executive compensation at private U.S. companies. The median YoY change in cash compensation is historically flat—while the top quartile changes in base salaries and bonuses are an average of 3.43 and 6.50 percent per year, respectively, when looking back at the past five years.

None of which is likely a surprise for readers of Chief Executive. As we’ve pointed out many times before, there is an abundance of anti-business spin surrounding chief executive pay, usually targeting the leaders of the largest 500 companies in the country. But, as you all know, most CEOs in America run private companies, and almost none of them are paid like their public company counterparts, whose pay garners consistent headlines for jaw-dropping salaries and double digit raises.

Much of the data reported about large public company CEOs emphasizes the equity portion of their comp plan. Our data shows unlike their public company counterparts, the median private company CEO does not typically receive new equity grants each year.

Nevertheless, Chief Executive’s 2022-23 report shows that the median CEO does own approximately 10 percent of their company’s equity, for a value of $1.75 million. While that’s a sizable interest, the challenge for private companies is determining the appreciation of this equity stake. Unlike public companies, most private companies do not value themselves annually.

However, in 2021, the median CEO overall reported equity gains of $30,000—a figure that has previously remained $0. One reason why this figure increased is that 2021 was a strong year for the stock market and for private businesses. Another reason is that as public companies continue to offer equity incentives to top executives, more and more private companies are estimating their enterprise value increases—and communicating that to their CEO. This may point to a change in best practice where privately held companies have begun to value themselves more often.

And even when the data is available, it is highly correlated to various factors, particularly company size. For instance, the median increase in equity value in 2021 for CEOs of companies with $5 to $9.9 million was $27,800. At the other end of the scale, the median CEO at companies with $1 billion + in revenues reported a $682,000 increase in their equity value in 2021.

There are many other variables that influence CEO compensation, and equity specifically. Ownership type and sector, among others, play significant roles. In 2021, for instance, we observed large equity appreciations in sectors like technology and wholesale/distribution, whereas most other industries saw appreciations under $100,000. Only three industries reported no equity gains in 2021—a striking difference from 2020 and most likely a result of PPP loans being forgiven in 2021 and being recorded as equity.

For more information, go to: ChiefExecutive.net/CompensationReport.

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.