Recession-Proof Your L&D Strategies and Budget For Future Success

AIHR

APRIL 20, 2023

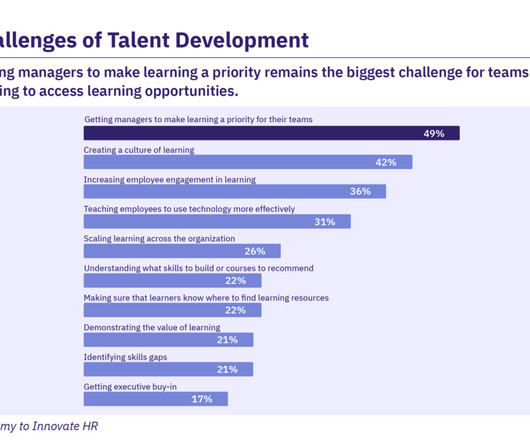

Similarly, L&D professionals have also struggled to provide an informed perspective of the risks associated with not developing individuals, and specifically how this will impact the ability of business to operate. The majority of budget resides in fixed costs related to headcount.

Let's personalize your content