Payroll Adjustment

Zenefits

MAY 25, 2023

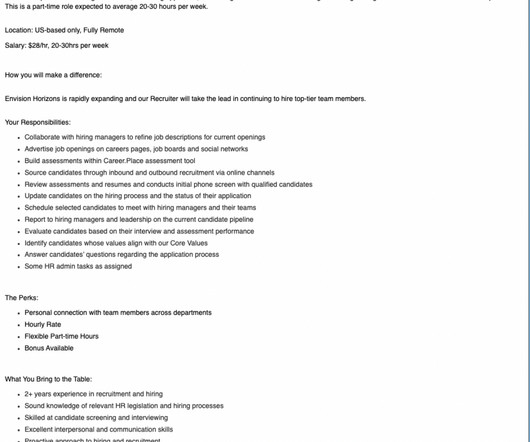

To stay in compliance with employment laws and regulations requiring employers to keep accurate payroll records. It’s especially important that overtime wages be paid correctly to comply with federal, state, and local regulations. Or they can be due to external forces, such as changes in tax rates. Overtime pay.

Let's personalize your content