Why LLCs Are A Great Vehicle For Asset Protection When Purchasing Real Estate

Forbes Leadership

JULY 22, 2022

In this article, I am going to share with you why LLCs are a great vehicle for asset protection when purchasing real estate.

Forbes Leadership

JULY 22, 2022

In this article, I am going to share with you why LLCs are a great vehicle for asset protection when purchasing real estate.

SME Strategy

JUNE 6, 2023

In this interview, we have the privilege of talking to Alastair Wood , Vice-President & General Counsel at Rhino , a New York-based real estate startup that aims to bring greater financial freedom to renters everywhere. How did you handle the situation, and what insights did you gain from it?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Peter Winick

DECEMBER 18, 2023

And then obviously the asset we’re looking at is kind of the context. And so that is part of the content of that asset is we have one of the largest, you know, highest grossing food halls. There’s you know, we’ve got a shoe repair store at one of our assets that people go to, a tailor sessions, parties, etc.

Forbes Leadership

JANUARY 25, 2023

Surplus office space, in fact, should be seen as an asset, not a liability. There are many practical uses of surplus office space. This is not a new challenge. Many others have been there before. Study what they did right, or wrong in some instances, and act accordingly.

Chief Executive

APRIL 3, 2023

Today, our advisors are helping clients build and bolster their plans—strengthening emergency savings accounts, paying down high-interest debts, protecting the wealth they’ve already built and accumulating assets for the future. All told, we spent $14 billion to buy risk assets near market lows.

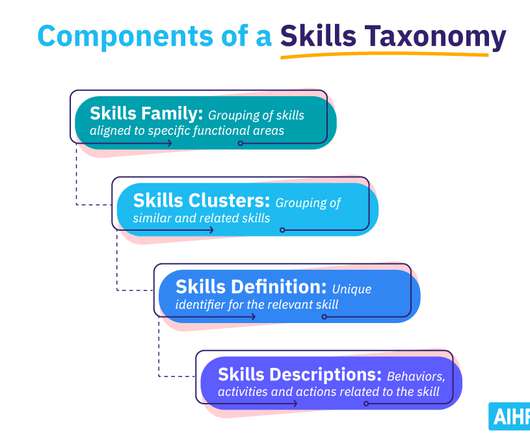

AIHR

AUGUST 3, 2022

Reduction in new real estate investment and freeze current expansion projects, yet maintenance of current footprint remains a priority. Do not renew current leases and consolidate real estate assets • Expand logistics capability and invest in additional skills and technologies. Property Development.

Chris LoCutro

SEPTEMBER 12, 2023

So since everyone's situation is different, whether we're talking about a personal loan or a business loan, for real estate or to consolidate debt, there are a lot of factors to consider. And if you can't repay, they'll come for your home, your personal assets, whatever it is, because you might have that loan in your name.

Let's personalize your content