Managing Risk from Every Level of Your Organization

Liquid Planner Leadership

MAY 24, 2022

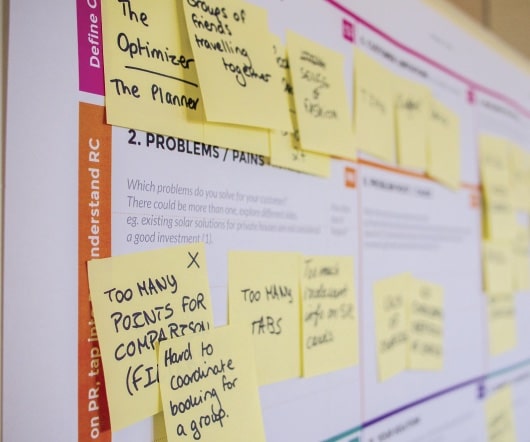

Risk is not solved with a calculation. Risk management requires effective communication, among all team members, throughout project delivery. Make no mistake, meaningful and accurate risk analysis is a critical first step for establishing credible and defensible baseline plans. Hillson, D. 2003, September 25).

Let's personalize your content